So you're considering an adjustable rate mortgage

Viral Shah (Better Mortgage’s Head of Capital Markets) explains what he wishes he had known about ARMs when he bought his home.

When I bought my home 4 years ago, I got a fixed-rate loan, like 98% of homebuyers do today. My loan officer didn’t even bring up the idea of an adjustable-rate mortgage (ARM) – maybe because ever since the 2008 housing crisis, ARMs have gotten a bad rap.

But knowing what I do now, an ARM would have been the cheaper and more appropriate choice for me, because I knew for certain that I wasn’t going to stay in the home for more than 5-7 years. All in all, I could’ve saved over $5,000 in interest over the last few years if I had chosen differently.

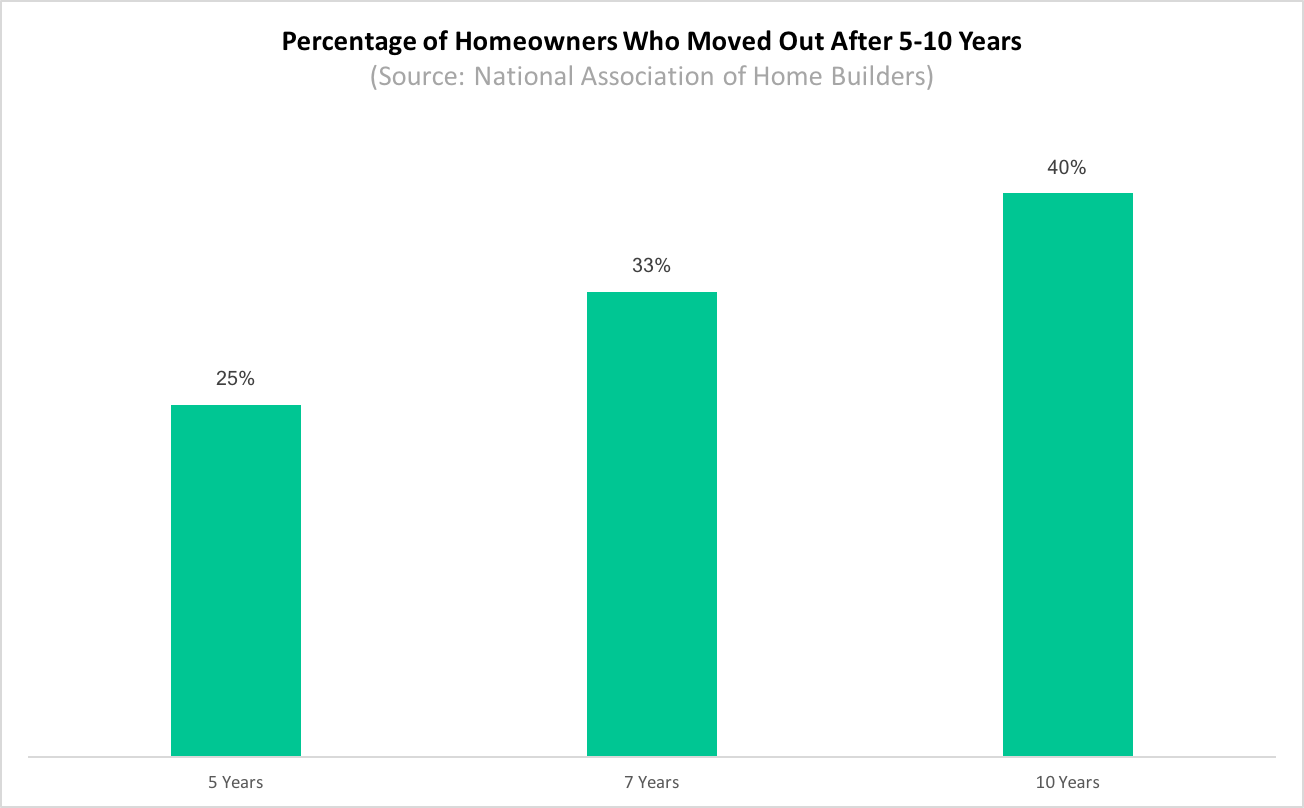

A lot of people move within 5-7 years. According to the National Association of Home Builders, 40% of homeowners move out after 5-10 years:

What’s the difference between a fixed-rate mortgage and ARM?

Fixed-rate mortgages offer just that – you get the same, fixed interest rate over the course of your loan (typically 15, 20, or 30 years). No surprises.

Adjustable-rate mortgages (ARMs) typically offer you a lower rate for an initial fixed period (5, 7, or 10 years). After that initial period is over, the rates will adjust (and typically increase) each year based on market rate factors. Note that there is a predetermined cap that establishes the maximum amount rates can increase each year – so you’ll know the “worst-case scenario" going in. Want to learn more about how ARMs work and how much your rates might go up? Head here.

Is an ARM right for you?

If you’re not planning on staying in your home for longer than 5-10 years, an ARM allows you to take advantage of the initial low rate.

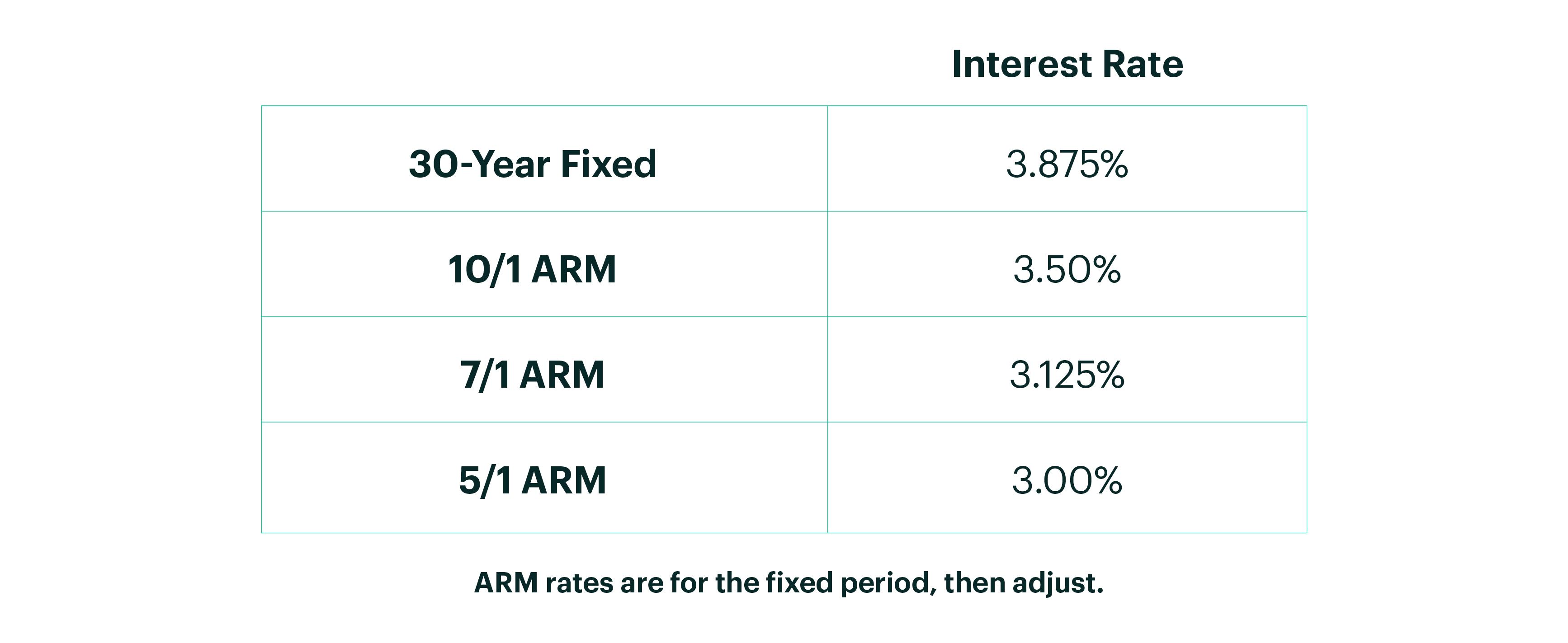

As of 4/13/2017, here’s a sample purchase loan a consumer may qualify for:

How much could you save?

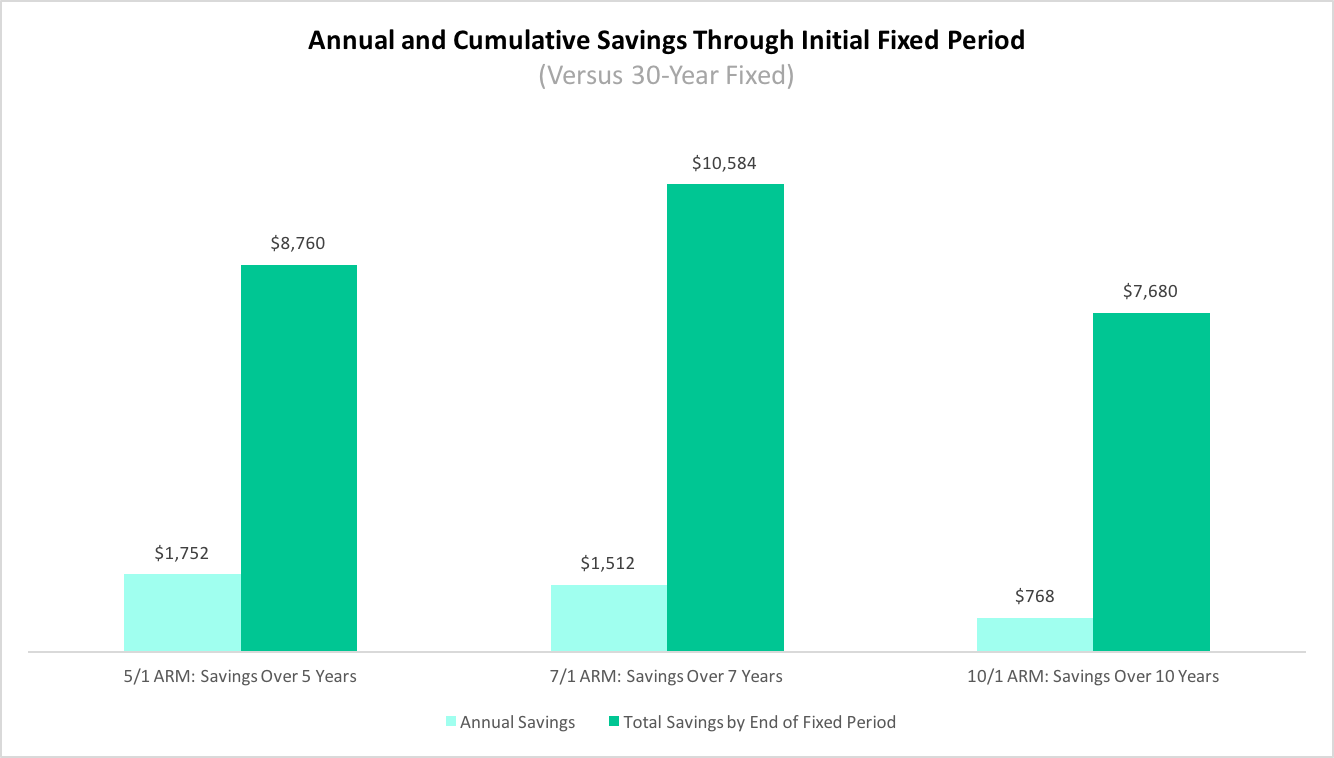

This table shows the annual and cumulative interest savings for a $300,000 loan, assuming you move out of your home at or before the end of the fixed period.

Other reasons to choose an ARM (crystal ball required)

Some lenders might suggest additional reasons for choosing an ARM, but we think they can come with more risk. Let’s go over a few of them:

1) You anticipate being able to afford higher payments later on because of your career trajectory, a partner rejoining the workforce, or an expected inheritance.

Why we’re cautious: Life is unpredictable, and even the most solid plans can fall through. You might want to consider consulting with a financial advisor if you’re trying to figure out whether you’ll be able to afford a higher monthly mortgage bill down the line (using the “worst-case scenario” numbers).

2) You’re banking on refinancing your loan before or soon after the fixed period ends.

Why we’re cautious: Again, life – and the economy – can be unpredictable. Just like getting your initial mortgage, a lot of requirements and factors are involved in successfully refinancing your mortgage, which means there’s no guarantee you’ll be able to lock in a lower rate down the line.

Take a Master Class in Mortgaging with Our Free Guide. Get the Guide

Conclusion

At Better Mortgage, we believe in only recommending loan products that are in the best interest of the buyer. That’s why none of our Mortgage Experts receive commissions – they’re solely here to support you. So, while there are other reasons why an ARM might be appealing, the only case we feel strongly about is the home scenario in which you’re certain that you’ll be selling the house within 10 years.

The great news is if you plan on being in your home for 10 years or less, a 10/1 ARM can save you thousands (almost $7,000 over the 10-year period for a $300,000 loan, as shown above). But if you’re planning on staying in your home long-term, or are uncertain about how long you’ll be there, we recommend doing the math and consulting a financial professional who can help you understand if you'll be able to afford higher mortgage payments in the future.

If you’re curious about what ARM rates are like today, take a look at our Rate Quote Tool, and if you’d like to talk through your specific scenario with one of our Loan Consultants, you can schedule a conversation or call us at 888-501-3186. We’re here to help you figure out which option is right for you.