The pros and cons of refinancing

What You’ll Learn

The advantages and disadvantages of refinancing

Scenarios of when you should and shouldn’t consider a refinance

How to make the most of refinancing

If you've been following the news, you may have heard about mortgage rates being on the decline. And if you're like a lot of homeowners, you may be wondering if that makes now a good time to refinance. The truth is refinancing is never a simple decision. Low rates are certainly a good motivator to explore your options, but the best time to refinance depends on your unique financial goals.

If you’ve been thinking about refinancing, it helps to understand the true benefits and potential drawbacks of the process. Let's go over a few scenarios where refinancing may be the right move.

Advantages of refinancing

Refinancing can decrease your mortgage interest rate

When it’s right for you:

- You bought your home when interest rates were higher

- Your credit score or financial circumstances have improved since you got your mortgage

The interest rates you receive on a mortgage depend on a number of circumstances, such as the current market, your credit score, and how much risk you pose as a borrower. And if any of these circumstances improve, you could be eligible for a completely different mortgage rate. Even a small decrease can save you money on interest in both the short- and long-term.

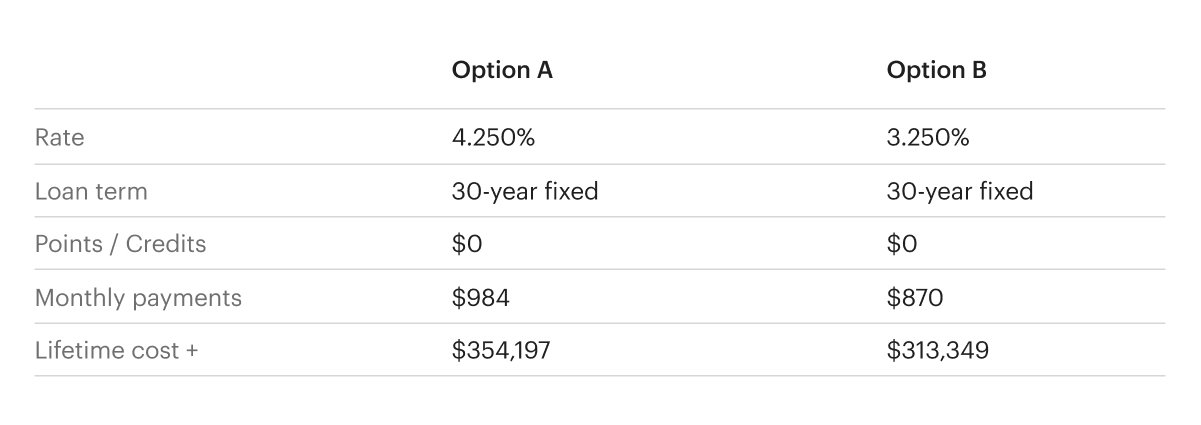

Here’s the difference that a 1% change can make on a 30-year fixed-rate mortgage:

This chart is for illustrative purposes only.

In this instance, not only would the interest rate decrease provide savings of $114 per month, but it would also save you more than $40,000 over your full loan term! Try out our loan comparison calculator to find out how much you can save.

Refinancing can lock in consistent mortgage payments

When it’s right for you:

- You currently have an adjustable-rate mortgage

Adjustable-rate mortgages can be an enticing prospect when you first get a mortgage—they typically offer great rates for a set number of years. However, once the fixed-rate timeframe runs out, your interest rate is subject to fluctuations with the market. This could potentially mean higher monthly payments down the road. Refinancing to a fixed-rate mortgage could help you secure a low mortgage rate that will never increase—even if the market does.

Refinancing can lower monthly mortgage payments

When it’s right for you:

- You want more financial flexibility month to month

- You’re saving for a long-term purchase, such as a child’s college tuition

- You recently went from a two-income household to one-income household

- You took on another large loan payment

Regardless of your “why,” refinancing can be a great tool to help you save on your monthly expenses, giving you more room for your other needs or goals. One way to do this is by lengthening your loan term. For example, if you’ve been paying your 30-year mortgage for the past 5 years and you refinance to a new 30-year mortgage, your remaining balance will be spread over an additional 5 years. This longer term can help decrease your mortgage payments and give you extra wiggle room in your budget to meet your needs.

Keep in mind that a longer loan term means you’ll be paying interest for a longer period of time as well. However, if you can refinance to a lower rate, too, then the interest savings could help offset the cost.

Refinancing can help you ditch PMI

When it’s right for you:

- If you put less than 20% down when you purchased your home

- If you refinanced previously but still required private mortgage insurance

The challenge of coming up with a 20% down payment is difficult for many homebuyers—especially first-timers. In fact, according to a recent survey by the National Association of Realtors, more than three-quarters of first-time homebuyers end up putting less than 20% down.

While the option of a lower down payment may have helped you afford your home, it also likely meant an added cost: private mortgage insurance (PMI). Most lenders require the additional monthly cost of PMI to offset the risk of approving homebuyers who have less cash or equity up front.

If you’ve paid off enough of your current mortgage, or if your home has increased in value, then you may have enough home equity to get rid of PMI with a new loan.

Refinancing can give you access to cash

When it’s right for you:

- You want to do home renovations

- You need to consolidate or pay off high interest debt, like credit cards

- You want to invest in a business or new property

- You need money now for other goals

If you need cash to help fund a material goal, then a cash-out refinance may be your answer. In this instance, you essentially take out a new mortgage for a larger sum than your existing loan balance but less than your home’s market value. You can then withdraw the difference in cash directly to your bank account.

Refinancing can help you save thousands on interest

When it’s right for you:

- Your financial situation has greatly improved

- You moved in with a partner, or got married, and now have two incomes

- You got a significant raise

- You received a large inheritance

Many homebuyers choose a 30-year mortgage because the long loan term helps spread out payments to make them more affordable. But a 30-year loan means 30 years of interest payments—which can really add up.

If your financial situation has greatly improved since you bought your home, it may make sense to shorten your term. Yes, by choosing a 15- or 20-year mortgage, your monthly payments may increase. However, you’ll pay off your home in a much shorter time frame and save thousands on interest charges overall. Keep in mind: Total interest paid on a 30-year mortgage is double what it would be on a 15-year at the same interest rate. And with interest rates at record lows, you may find that your payments are similar, even with a shorter term.

Disadvantages of refinancing

There’s no guarantee you’ll be approved for a refinance

When it may not be right for you:

- You recently went through a job loss or major change in employment

- Your credit score has drastically reduced

- You recently took on significant debt

- Your savings accounts have seen better days

Qualifying for a refinance is similar to the approval process you went through when you first got your mortgage. You’ll need to provide documentation and evidence of a stable employment history, good credit score, minimal debt, and a certain amount of assets. If you’ve experienced any financial hardships lately, such as a bankruptcy, a foreclosure, or have had difficulty paying bills on time, it may be best to recover before applying for a new home loan.

Your home may not have appreciated in value

When it may not be right for you:

- You bought your home at the height of the market when housing prices were higher

If home values are on the decline in your area, refinancing may be more difficult. When you refinance, the lender will use the results of a new home appraisal to determine how much equity you have built up in your home. The lower the appraised value is, the less equity you will have.

If your loan-to-value (LTV) ratio is too low, then you may need to wait to refinance until you’ve built up additional equity. In some cases, you may still be able to refinance. However, you’ll be subject to a PMI requirement on your new loan. You may also not qualify for the best interest rate because borrowers with less equity are considered more of a risk to a lender.

Refinancing costs money, and you won’t always break even

When it may not be right for you:

- You plan to move in the next few years

- You plan to refinance again soon

When you refinance, you have to pay closing costs, just as you did when you purchased your home and got your initial mortgage. The costs to refinance are typically around 2–5% of your loan balance and cover expenses for third-party services, like your title search and insurance, appraisal, and county recording fees. Some lenders also charge lender fees, such as application, origination, and underwriting fees and loan officer commissions. (Hint: You can save on closing costs by selecting a lender who doesn’t charge unnecessary lender fees.)

Because it will take some time before you recoup the expense of securing your new loan, think about how long you intend to keep the mortgage. You want to ensure it’s a long enough timeframe for you to “break even,” or hit the point where your savings begin to outweigh your refinance costs.

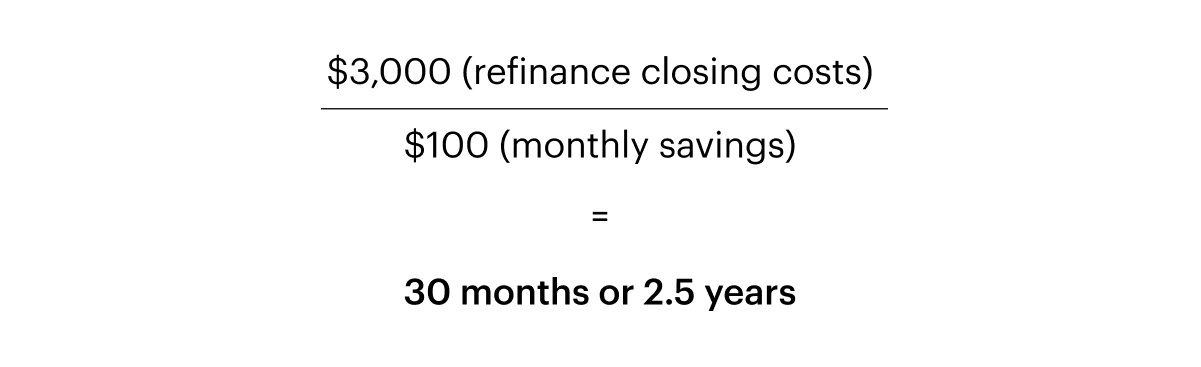

Let’s say the total cost for your new loan is $3,000, and you’ll save $100 monthly by refinancing. In this scenario, it would take you two-and-a-half years to break even.

This chart is for illustrative purposes only.

If you won’t remain in your new mortgage for at least the amount of time it will take to break even, then refinancing may not make sense. You can use our break-even calculator to help you determine how quickly you’ll see the savings from a new loan. And if coming up with money out of pocket for closing costs sounds less than appealing, don’t worry—a no-closing cost loan could help you avoid upfront refinance expenses. With a no-closing cost loan, you’ll be able to roll some or all of your closing costs into your new mortgage, so you can avoid spending the money all at once.

How to make the most of refinancing

If you’ve considered the above pros and cons and determined that refinancing could be the right move for you, then make sure that you're getting the most bang for your buck. There are ways to reduce the short- and long-term costs of refinancing, such as improving your credit score, negotiating closing costs, and shopping around for the right lender.

Remember, not all lenders are equal. Selecting a lender that doesn’t impose unnecessary fees could save you hundreds, if not thousands on closing costs. This means you’ll start seeing your refinance savings much sooner. At Better Mortgage, we never charge lender fees, like application fees, origination fees, or underwriting fees, and our loan officers never get paid commission.

Get pre-approved in as little as 3 minutes, and see your rates today.

This blog post is for informational purposes only, and is not intended to provide, and should not be relied upon for tax, legal or accounting advice.