What is included in closing costs?

Every real estate transaction comes with fees, no matter how you pay. Learn what is included in closing costs, when they’re due, and what they all mean.

Read more

Every real estate transaction comes with fees, no matter how you pay. Learn what is included in closing costs, when they’re due, and what they all mean.

Read more

Discover conventional loan requirements, how they compare to FHA and VA loans, and find out if this type of mortgage is the right fit for your situation.

Read more

What is an escrow account? Learn how it works, and why it helps protect buyers, sellers, and lenders. Discover the types, rules, and their real estate benefits.

Read more

Learn how title and settlement services help you close on a home, from title searches to insurance, escrow, and signing, plus what to expect at every step.

Read more

Two ways that refinancing can benefit homeowners going through a divorce

Read more

Protect your new home with safety measures designed to combat the risk of fire, carbon monoxide poisoning, flooding, and burglary.

Read more

Confused about no cash out refinance vs. limited cash out refinance? Discover the benefits, differences, and which option is best for your mortgage strategy.

Read more

With a cash out refinance, you take out a new mortgage for more money than you owe on your current loan. The difference is paid to you in cash.

Read more

Refinance appraisal higher than expected? Understand the appraisal process, associated costs, and what it means for your refinancing options and mortgage terms.

Read more

Learn the differences between jumbo vs conventional loan types, county loan limits, qualifying guidelines, and how to know if you should consider a jumbo loan.

Read more

Tips for comparing the affordability of renting and buying a home, and deciding which one might be right for you.

Read more

Get approved for a mortgage for self-employed borrowers: understand income docs, tax write-offs, down payment proof, and tips to boost eligibility with lenders.

Read more

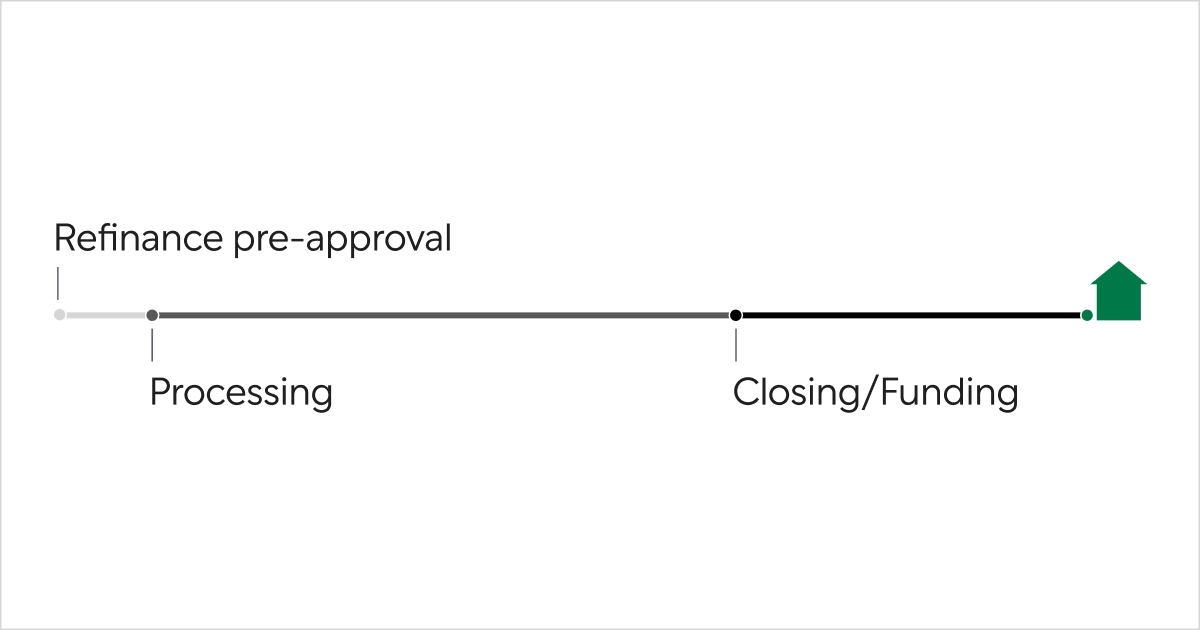

Refinancing can help homeowners save money, but the process can be complex. Here's how Better simplifies it and what you can expect from start to finish.

Read more

Learn what makes property value increase and learn 10 important factors that significantly impact how much a home is worth when buying, selling, or refinancing.

Read more

HomeReady vs FHA loans: See how an affordable home financing program that offers low down payment options like HomeReady stacks up against FHA loans.

Read more

Mortgage application denied? Discover common reasons for denial and expert tips to strengthen your next application and boost your chances of getting approved.

Read more

Learn how a loan estimate reveals real mortgage costs, compares lenders, and highlights fees you can control. Explore its sections and compare offers clearly.

Read more

In the socially distanced world of 2020, Better helped 88,100+ new clients navigate their homeownership journey with ease, confidence, and a ton of savings.

Read more

Second mortgages can be used to pay off debts, but they do come with risks. Learn about HELOCs, home equity loans, and piggyback loans in this new Better Mortgage article.

Read more

Thinking about refinancing your mortgage? Learn when to refinance, the benefits, and key factors to help you decide if now is truly the right time for you.

Read more

Need something else? You can find more info in our FAQ