IMPORTANT TERMS OF YOUR HOME EQUITY LINE OF CREDIT

Retention of Information: This disclosure contains important information about your Home Equity Line of Credit. You should read it carefully and keep a copy for your records.

Availability of Terms: All of the terms described below are subject to change. If these terms change (other than the ANNUAL PERCENTAGE RATE) and you decide, as a result, not to enter into an agreement with us, you are entitled to a refund of any fees that you paid to us or anyone else in connection with your application.

Security Interest: We will take a security interest in your home. You could lose your home if you do not meet the obligations in your agreement with us.

Possible Actions: We can terminate your credit line, require you to pay us the entire outstanding balance in one payment, and charge you certain fees if: (i) You engage in fraud or material misrepresentation in connection with the line; (ii) You do not meet the repayment terms; (iii) Your action or inaction adversely affects the collateral or our rights in the collateral. We can refuse to make additional extensions of credit or reduce your credit limit if: (i) Any of the reasons mentioned above exist; (ii) The value of the dwelling securing the line declines significantly below its appraised value for purposes of this line; (iii) We reasonably believe you will not be able to meet the repayment requirements due to a material change in your financial circumstances; (iv) You are in default of a material obligation in the agreement; (v) Government action prevents us from imposing the ANNUAL PERCENTAGE RATE provided for or impairs our security interest such that the value of the interest is less than 120 percent of the credit line; (vi) A regulatory agency has notified us that continued advances would constitute an unsafe and unsound practice; (vii) The maximum ANNUAL PERCENTAGE RATE is reached. The initial agreement permits us to make certain changes to the terms of the agreement at specified times or upon the occurrence of specified events.

Minimum Payment Requirements: You can obtain advances of credit for 3 years (the “Draw Period”). At our option, we may renew or extend the Draw Period. The Draw Period will be followed by a “Hold Period” of 7 years. During the Hold Period, you may no longer request advances of credit. Further, during both the Draw Period and the Hold Period (together, the "Interest Only Period”), your minimum payment will equal the (i) the greater of $100 or (ii) total of (a) the periodic finance charges, and other fees, charges and costs including without limitation, any other expenses or advances incurred by us under the Security Instrument and (b) accrued but unpaid interest for prior Billing Cycles. The Interest Only Period will be followed by a “Repayment Period” of 20 years. During the Repayment Period, if any, your minimum payment will equal 1/240 of your unpaid Account Balance at the end of the Interest Only Period, plus all periodic finance charges, and other fees, charges, and costs. All payments will be due monthly.You may repay all or any part of your Account Balance, at any time, once your loan has been on boarded with the Servicer, without penalty, subject to the limitations of this Agreement.

• The minimum payment may not be sufficient to fully repay the principal that is outstanding on your line. If they are not, you will be required to pay the entire outstanding balance in a single payment.

Minimum Payment Example: If you received an Advance of $50,000 and made only the minimum monthly payments and took no other credit advances, it would take the following amount of time to repay this loan. These examples assume a minimum monthly payment of $100, but your minimum monthly payment may be a different amount. For a

- 5-years Draw Period followed by a 0-years Hold Period and a 10-years Repayment Period, it would take 180 months to pay off a credit advance of $10,000 at an ANNUAL PERCENTAGE RATE of 10.500%. During that period, you would make 60 monthly payments of $100.00 followed by 120 monthly payments of $134.93;

- 10-years Draw Period followed by a 0-years Hold Period and a 10-years Repayment Period, it would take 240 months to pay off a credit advance of $10,000 at an ANNUAL PERCENTAGE RATE of 10.500%. During that period, you would make 120 monthly payments of $100.00 followed by 120 monthly payments of $134.93;

- 10-years Draw Period followed by a 0-years Hold Period and a 15-years Repayment Period, it would take 300 months to pay off a credit advance of $10,000 at an ANNUAL PERCENTAGE RATE of 10.500%. During that period, you would make 120 monthly payments of $100.00 followed by 180 monthly payments of $110.54;

- 10-years Draw Period followed by a 0-years Hold Period and a 20-years Repayment Period, it would take 360 months to pay off a credit advance of $10,000 at an ANNUAL PERCENTAGE RATE of 10.500%. During that period, you would make 120 monthly payments of $100.00 followed by 240 monthly payments of $100.00

Fees and Charges: To open and maintain a line of credit, you must pay the following fees to us;

Discount Points: 0 - 5% of loan amount

Origination Fee: $0 - $995

Appraisal Fee*: $0 - $1,415

Credit Report Fee: $68.50 - $137

Flood Determination: $5

Owner & Encumbrance Report: $0 - $115

Settlement Fee: $0 - $475

Deed Preparation*: $55 - $110

Other Title Fees**: $0 - $3,000

Transfer Taxes***: 0 - 2% of loan amount

Recording Fee: $100 - $300

Estimated Survey Fee***: $1,000 - $4,200

Broker Fee****: 0 - 3% of loan amount

*Only if required

**Only applicable to 1st lien HELOCs

***Only applicable in certain states

****Only applicable to wholesale loans

You also must pay certain fees to third parties. Please note that these fees are only estimates.

Refundability of Fees: If you (1) withdraw your application for any reason after receiving this disclosure and the Home Equity Brochure via your initial consent for soft credit pull or (2) after 30 days of non-activity in the loan file, your application is withdrawn/denied due to profile incompleteness, you are entitled to a refund of any fee you may have already paid except for the following:

- Any Credit Investigation or Report Fees

- Any Appraisal Fees, including, but not limited to, Automated Valuation Model (AVM) fees, Truepic fees, or any other reasonable method necessary to determine the value of the collateral property resulting in a third-party service fee

- Flood Certification Fees

- Fraud Check Fees or any other fee resulting from a reasonable third-party service used to ascertain whether any fraudulent activity has occurred during the application process.

If this disclosure is mailed to you, you are considered to have received the disclosure three business days after we mailed the disclosures. Fee charges upon voluntary withdrawal or withdrawal/denial due to incompleteness are subject to state law and may not be applicable in all areas.

Late Payment: Subject to the maximum late payment fee allowable under applicable state law, payments that are 15 or more days late will incur an additional charge equal to the greater of 5% of the payment or $20.

Property Insurance: You must carry insurance on the property that secures the line. If the property is located in a Special Flood Hazard Area we will require you to obtain flood insurance if it is available. You may select the insurance company of your choice, provided the company and coverage meet our requirements.

Transaction Requirements: The minimum Initial Advance is 75% of the line amount or 50,000, whichever is greater. Subsequently, the minimum advance is $1000 or state minimum; Texas is $4000. You must maintain an outstanding balance of at least $0.

Negative Amortization: Under some circumstances, your payments will not cover the finance charges that accrue and “negative amortization” will occur. Negative amortization will increase the amount that you owe us and reduce your equity in the dwelling.

Tax Deductibility: You should consult a tax advisor regarding the deductibility of interest and charges for the line.

Other Products: If you ask, we will provide you with information on our other available home equity lines.

Variable-Rate Information: The Agreement has a variable ANNUAL PERCENTAGE RATE. The ANNUAL PERCENTAGE RATE and the amount and/or number of Minimum Payment may change as a result. The ANNUAL PERCENTAGE RATE includes only interest and not other costs. The Initial ANNUAL PERCENTAGE RATE may be “discounted.” Any discounted rate is not based on the index and margin used for later rate adjustments.

The ANNUAL PERCENTAGE RATE is based on the value of an index, and we may add a margin to the value of the Index. The “Index” is WSJ Daily Prime.

Ask us for the current index value, margin and ANNUAL PERCENTAGE RATE. After you open a credit line, rate information will be provided on periodic statements that we will send you.

Rate Changes: The ANNUAL PERCENTAGE RATE may be adjusted on the first day of each billing cycle (each, a “Change Date”). Each change in the ANNUAL PERCENTAGE RATE (and the related Daily Periodic Rate) will take effect without prior notice and will apply to both new Advances and your Account Balance.

The maximum ANNUAL PERCENTAGE RATE that can apply is 18%, subject to state limitations. The minimum annual percentage rate that will apply is 4%. Except for this 18% “cap” and this 4% "floor", there is no limit on the amount by which the rate can increase or decrease during any one-year period.

Maximum Rate and Payment Examples: If you had an outstanding balance of $10,000 during the Interest Only Period, the minimum monthly payment at the maximum ANNUAL PERCENTAGE RATE of 18% would be $150.00. This annual percentage rate could be reached during the first month of the Interest Only Period. During the Repayment Period, the minimum monthly payment at the maximum ANNUAL PERCENTAGE RATE of 18% would be $180.19 during a 10 year Repayment Period; $161.04 during a 15 year Repayment Period; and $154.33 during a 20 year Repayment Period.

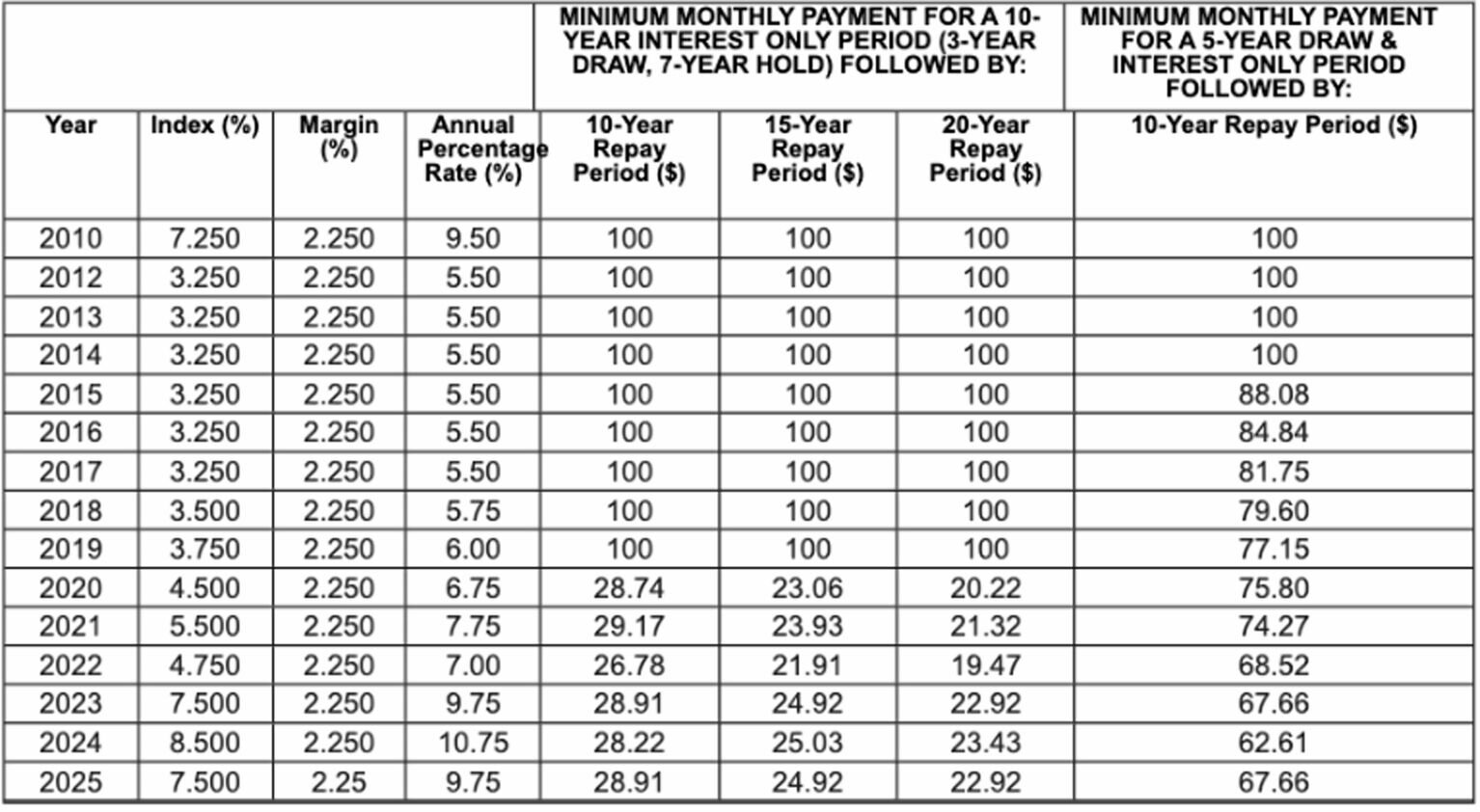

Historical Example: The following table shows how the ANNUAL PERCENTAGE RATE and the minimum monthly payments for a single $10,000 credit advance would have changed based on changes in the index over the past 15 years. The index values are from January 1 of each year. While only one payment amount per year is shown, payments during the Interest Only Period and Repayment Periods would have varied during each year. The table assumes that no additional credit advances were taken, that only the minimum payments were made each month, and that the rate remained constant during each year. It does not necessarily indicate how the index or your payments will change in the future. We have used the margin recently. Your margin may be different. The $100 payments reflect the minimum monthly payment amount. Your minimum payment may be a different amount.