We have funded $100 billion in home loans for over 400,000 customers like you

FHA loans

We are making homeownership even easier with FHA loans

A Federal Housing Administration (FHA) loan is a home mortgage insured by the government to help hardworking homebuyers.

3.5% minimum down payment for FHA loans through Better Mortgage*

No unnecessary fees.

580 Minimum credit score to apply for FHA loans through Better Mortgage.

Get pre-approved with no hard credit check. Insured by the Federal Housing Administration.

Questions about FHA ? We're here 24/7.

Call now | (888) 893-9159

What else makes us Better

Low rates that could save you thousands

Close 10 days faster than industry average

Apply 100% online, with

24/7 support

Get pre-approved in as little as 3 minutes

Better Mortgage took the inherent complexity and made it 10x more clean and simple.”

David B, Better Mortgage customer

Buy a $400,000 house with just $14,000 down*

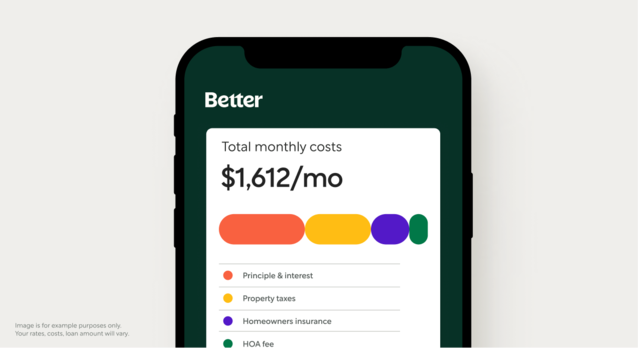

For example, a 3.5% down payment on a 30-year, fixed-rate purchase loan of $300,000 with an interest rate of 6.500% / (6.820% Annual Percentage Rate- APR) will have 360 monthly principal and interest payments of $2,479. This is for a Federal Housing Administration Loan (see qualifications at https://hudgov-answers.force.com/FHA/).

Payments shown do not include taxes and insurance. Actual payments will be higher. Example above is based on the following assumptions: borrower with an average credit score (i.e., FICO score of 675 or higher); maximum loan-to-value ratio of 96.5%; subject property is a Single Family Residence; subject property is borrower’s primary residence. Mortgage rates are based on current market conditions and change daily. Actual rates may vary.All mortgage loan products are subject to credit and property approval. Rates, terms, and conditions are subject to change without notice. Products are not available in all states. Other restrictions and limitations may apply.